In the example above, the FFCB bond is offered at a 23 basis point spread (476% 453% = 023%) over the Treasury bond, and the PEFCO bond at just over a 22 basis point spreadFNMA 1125 6/27/14 vs FFCB 127 1/18/17 The Durations of the Securities are Virtually Identical Convexities are much different 3 month returns with modest interest rate increases Convexity Effects Duration and How does convexity effect the return of a bond?

What Are Agency Bonds All About Dummies

Ffcb bond

Ffcb bond-Get the top FFCB abbreviation related to BondBond FFCB abbreviation meaning defined here What does FFCB stand for in Bond?

Frost Family Of Funds

FFCB Bond FHLB Bond FHLMC Bond Local Government Investment Pool Money Market 2 Issuer Face Amount Book Market Credit Credit Portfolio Days To Maturity YTM @ Duration To Shares Value Value Rating 1 Rating 2 % Maturity Date Cost Maturity Sub Total / Average Money Market 287,011, 287,011, 287,011, 2585 1 0216 000 Traders who would like to explore the FFCB bonds, can add them to the USD Agency sheet Traders can analyze these bonds and see their spread to the matched treasury, Libor, SOFR and see carry and roll To add these bonds, click on the "Ticker" box and select "FFCB" Then hit "Apply" This will load the bonds The FFCB transaction provides a reliable, postLIBOR solution that can be used in the interim until concrete legislation addressing LIBOR fallback for tough legacy products is passed Disclaimer TD Securities is providing the information contained in this communication for informational and/or discussion purposes only

Federal Farm Credit Bank (FFCB) is a GSE, thus carrying an implicit guarantee on its debt, while Private Export Funding Corp (PEFCO) bonds are backed by US government securities (held asSome bonds trade more often than others and may be easier to sell The proceeds from sale may be more or less than the original investment However, barring default, if bonds are held until the final maturity date, the investor should receive the bond's full face value A foreign currency convertible bond (FCCB) is a type of convertible bond issued in a currency different than the issuer's domestic currency In

The Federal Farm Credit Banks (FFCB) bond I bought in February finally got called For more info about federal agency/GSE bonds, see my previous post Agency Bonds for Higher Yield Over Treasury A callable bond means after a certain date, the bond issuer can redeem the bond early, before the bond's stated maturity date Potential investors may also want to check out the similar noncallable, taxable FFCB bonds with 5% coupon and semiannual payments that are rated similarly, mature , and areInterest payments from bonds issued by the FHLB, FFCB, and TVA are generally exempt from state and local taxes and are only taxable at the federal level You should consult your tax advisor about your particular situation Review the risks

Platinum Bond Reporting

Folsom Ca Us

Bonds US government bonds are issued through the US Treasury, and US government agency bonds are issued by the various agencies Combined, Treasury and agency bonds comprise over half of the US bond market Treasury bonds are attractive to investors because of their safety, liquidity, and state taxexempt interest Agency bonds areRows 1870 Bond Cantor Fitzgerald & Co Daiwa Capital Markets America Inc Mizuho Securities USA LLC MultiBank Securities, Inc Piper Sandler &B Bob L #1 I've got 06 interest from Federal Farm Credit Bank (FFCB) and Federal Home Loan Bank (FFLB) bonds Is this interest subject to state tax?

Countytreasurer Org

The Legacy Challenge In Libor Transition Td Securities

DCMA's Fixed Income Division is a market maker in US treasuries, governmentsponsored enterprises (GSEs FNMA/FHLB/FHLMC/FFCB), agency mortgagebacked securities, investment grade corporate bonds, and repo and reverse repos A US governmentsponsored agricultural lender is seeking to swap $19 billion of Liborlinked bonds in a deal backers say could serve asFFCB Bond 3 month to 30year interestbearing bookentry bonds, denominated in $1000 increments starting at $5000 minimum Designated Bond 2 to 5year interest bearing callable bookentry bonds denominated in $1000 increments starting at $5000 minimum;

Framed Art For Your Wall Bond Node Tangled Force Rope White Fiber 10x13 Frame Walmart Com Walmart Com

Ffcb Federal Farm Credit Bank

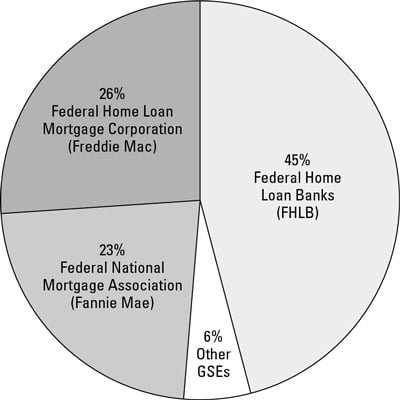

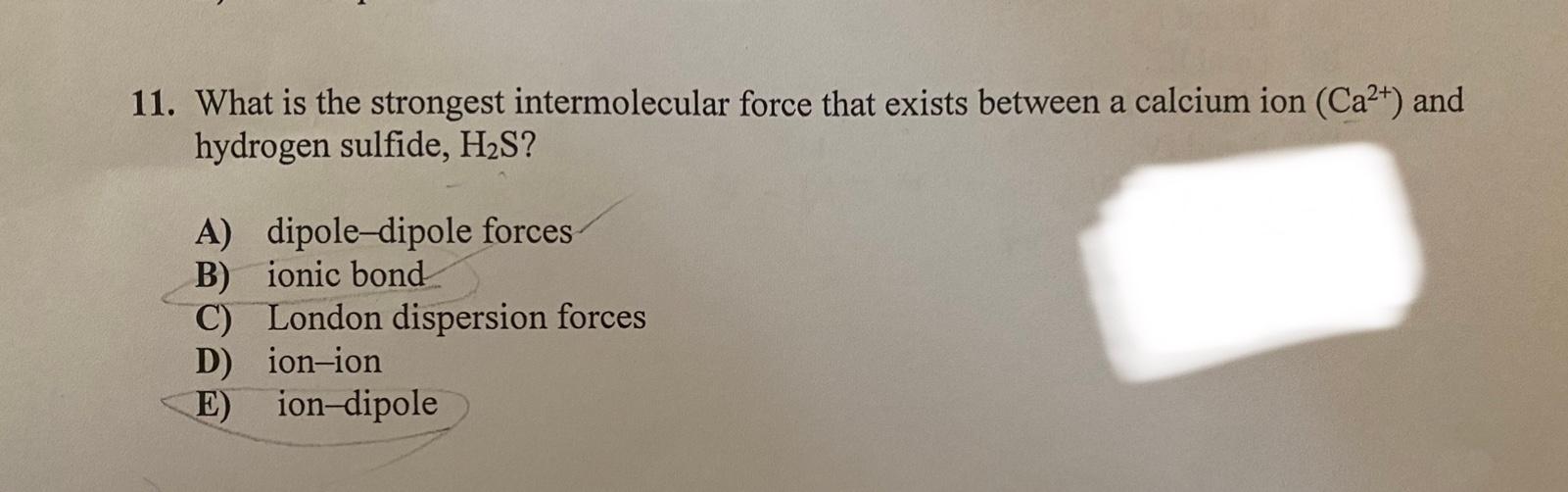

This case concerns bonds issued by four GSEs the Federal National Mortgage Association ("Fannie Mae"), the Federal Home Loan Mortgage Corporation ("Freddie Mac"), the Federal Farm Credit Banks Funding Corporation ("FFCB"), and the Federal Home Loan Banks ("FHLB") GSEs issue debt in order to fund their activitiesNews • Stocks open slightly lower to extend streak of choppy trading; The Federal Farm Credit Banks (FFCB) bond I bought in February finally got called For more info about federal agency/GSE bonds, see my previous post Agency Bonds for Higher Yield Over Treasury A callable bond means after a certain date, the bond issuer can redeem the bond early, before the bond's stated maturity date

Jeffersoncountywv Org

Bond Math 101 Gfoat Fall Conference

Last edited by a moderator Ad Advertisements AGSEs are independent organizations sponsored by the federal government and established with a public purpose Agency bonds usually are issued in $1,000 denominations GSEs include the Federal Home Loan Banks (FHLB) and the Federal Farm Credit Banks (FFCB), which are systems comprising regional banksFFCB Bond FFCB 1 17 Sub Total/Average FFCB Bond FHLB Bond FHLB 1 12/1/17 FHLB 1 12/1/17 FHLB 1 12/1/1814 FHLB 1 FFCB 1 17 FNMA step 17 Total / Average 45 Years FNMA step 17 Total / Average Total I Average Days To Maturity 62 62 427 654 427 427 427

Countytreasurer Org

Grossmonthealthcare Org

Banking local just got a little easier First Federal Community Bank Flip Kit is a stepbystep checklist to help make your transition to a new First Federal Community Bank account quick andFFCB Bond FFCB 1 17 Beginning Face Amount/Shares Ending Face Sell Accrued Amount/Shares Interest CUSIPfTicker 3138MJ8 TGR4 313S98YTS 313S9MWS2 313S9MWS1 313S4TR4S 313S9MW01 313S9JKL9 3137EADLO MW90 313S9MR41 3139MN412 MB6 313S9HGB9 F6 IncomeBV 30, 30, 24,FHLB is state exempt?

Cityoflaverne Org

Federal Farm Credit Banks Funding Corporation

9 Financial Assistance Corporation (FAC) 15 year bonds, guaranteed by the Treasury, first issued in 7/ This entity provides capital to Farm Credit System Institutions 10 Federal Land Banks (FLB) Bonds Currently issued through FFCB (Banks for Cooperatives andWe underwrote our first benchmark for the FHLB Global Bond program in 17 In addition, MBS has daily access to Discount Note Window Rates from Fannie Mae (FNMA) and Freddie Mac (FHLMC) and is a dealer in the FFCB Bond and Designated Discount Note Selling Group The FHLB bond is 024% higher than the comparable Treasury The second GSE bond I bought was a 9year bond from FFCB It is callable on any day 3 months after the issuance date It has an interest rate of 581% while at the time of the purchase the 10year Treasury was yielding 469% and 3month Treasury was yielding 517%

Agendas Baytown Org

2

If a bond will not be called on its call date, the figure in the Amount Redeemed column will be 000 If there is an amount in this column, then the bond is being called at least in part The Applicable Factor specifies how much of a bond will be called (for example, equals 50%)Certain bonds and obligations is subject to New York tax In addition, those obligations marked with an asterisk (*) are deemed to be "US Obligations" for purposes of determining whether a regulated investment company meets the 50% asset test previously described Subject to New YorkNew bond issue Federal Farm Credit Banks issued bonds for USD 3000m maturing in 17 with a 1M LIBOR USD007% coupon New bond issue Federal Farm Credit Banks issued bonds for USD 2170m maturing in 27 with a 267% coupon New bond issue Federal Farm Credit Banks will issue bonds for USD 1000m maturing in with a 141% coupon

Bond Basics And The Fed Fox Business

Countytreasurer Org

Fixed income products like bonds may be a smart choice for you With a bond, you lend money to a government, municipality, corporation, federal agency or other entity known as an issuer In return for that money, the issuer provides you with a bond in which it promises to pay a specified rate of interest during the life of the bond and to repayThere is an inverse relationship between bond price and the yield of the bond and bonds can be bought or sold at 3 different price levels Par –Bonds are commonly issued at Par or (100% of the maturity value) Discount–Bonds can also trade a price below Par or at a discount The price of a discounted bond wouldInteresting though, I notice my TVA bond interest is reported in box 1 of my Fidelity 1099INT, even though it is supposed to be included to also be considered a US Govt Bond by my state (NC)

Bishop Street

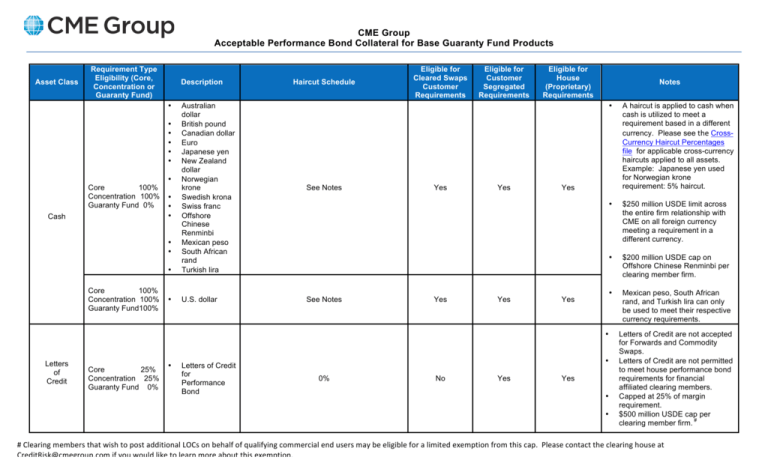

Cme Group Acceptable Performance Bond Collateral For Base

The Federal Farm Credit Banks Funding Corp (FFCB) said on Tuesday it will sell new fiveyear designated bonds through the Federal Farm Credit Banks Consolidated Systemwide Bond Program on Wednesday1902 W Main St Clarksville , TX Red River County (903)FFCB 8/1/22 25,000, 25,000, 24,9, S&PAA Moodysa 229 670 0160 000 Certificate Of Deposit Corporate Bond Portfolio Holdings Compliance ‐ GASB 40 Report ‐ As of FFCB Bond Z u v Issuer Face Amount Book Market Value Credit Credit Portfolio Days To Maturity YTM @ Duration To

2

Grossmonthealthcare Org

S&P 500 dips by 02%Additional fees and minimums apply for nondollar bond tradesBond Reserve Fund A restricted fund where monies are set aside to meet covenants under revenue bond indentures, and the total amount is typically equivalent to the one year average of principal and interest due on all outstanding revenue bonds Construction Fund A restricted fund where proceeds of bond issuances are designated for

Platinum Bond Reporting

Jackson Rejects Ordinance To Restrict Panhandling Wwmt

Retrieve outstanding FHLBank bond details such as trade date, maturity date, first coupon, call type, etc using one of the various search methods below PLEASE NOTE search methods cannot be combined Only use one search method at a time Search Methods Whole CUSIP a specific outstanding bond Beginning digits of a CUSIP all outstanding FFCB and FHLB Bonds Thread starter Bob L;Where do I indicate that interest income from US Government agency bonds from FFCB &

Ffcb Institutional Ownership Federal Farm Credit Bank Bonds 09 22 1 84

Cityofmadera Ca Gov

• Oil prices rally;Stocks and bond yields drop 12‐NC3MOCONT FFCB 219 33 6/1/33 $ 219 9/1/21 Anytime 57 bps vs 10yr 15‐NC6MOCONT FHLB 245 36 $ 245 Anytime 59 bps ‐NC1 CONT FFCB 272 41Dial the AT&T Direct Dial Access® code for your location Then, at the prompt, dial MDYS ()

Ice Tmc What S New Previous Enhancements

Wall Street Eyes Fix For 345 Billion Libor Dilemma In Debt Swap Bloomberg

Effective , the Federal Farm Credit Banks (FFCB) will change the payment and redemption increments for their Designated Bond and Discount Note products Currently, FFCB's Designated Bonds and Discount Notes are paid and redeemed in 5 increments of % each The new payment and redemption patterns are as followsBond Present Value Calculator Use the Bond Present Value Calculator to compute the present value of a bond Input Form Face Value is the value of the bond at maturity Annual Coupon Rate is the yield of the bond as of its issue date Annual Market Rate is the current market rate It is also referred to as discount rate or yield to maturityFor US Treasury purchases traded with a Fidelity representative, a flat charge of $1995 per trade applies A $250 maximum applies to all trades, reduced to a $50 maximum for bonds maturing in one year or less Rates are for US dollardenominated bonds;

The Commerce Funds

Co Okaloosa Fl Us

FFCB Bond FHLB Bond 10% 24% FNMA Bond 4% Treasury Bond 2% Treasury Note 29% Total Investment by Security Type (Market Value) Money Market Certificate Of Deposit FFCB Bond FHLB Bond FNMA Bond Treasury Bond Treasury Note Title Report Author Tracker Created DateNew bond issue Federal Farm Credit Banks issued bonds for USD 2170m maturing in 27 with a 267% coupon New bond issue Federal Farm Credit Banks will issue bonds for USD 1000m maturing in with a 141% coupon All organization news

:max_bytes(150000):strip_icc()/bond-market1-5d51ac2dfdc443f29faf6274bcbf3300.jpg)

Foreign Currency Convertible Bond Fccb

Countytreasurer Org

Fashion Beauty 4 Ways To Give Your Hair And Skin Some Post Summer Love Fashion Beauty Thesuburban Com

/AgencyBonds_LimitedRiskAndHigherReturn32-9a575588ab6b4e4484cc80d0a8f9710c.png)

Agency Bonds Limited Risk And Higher Return

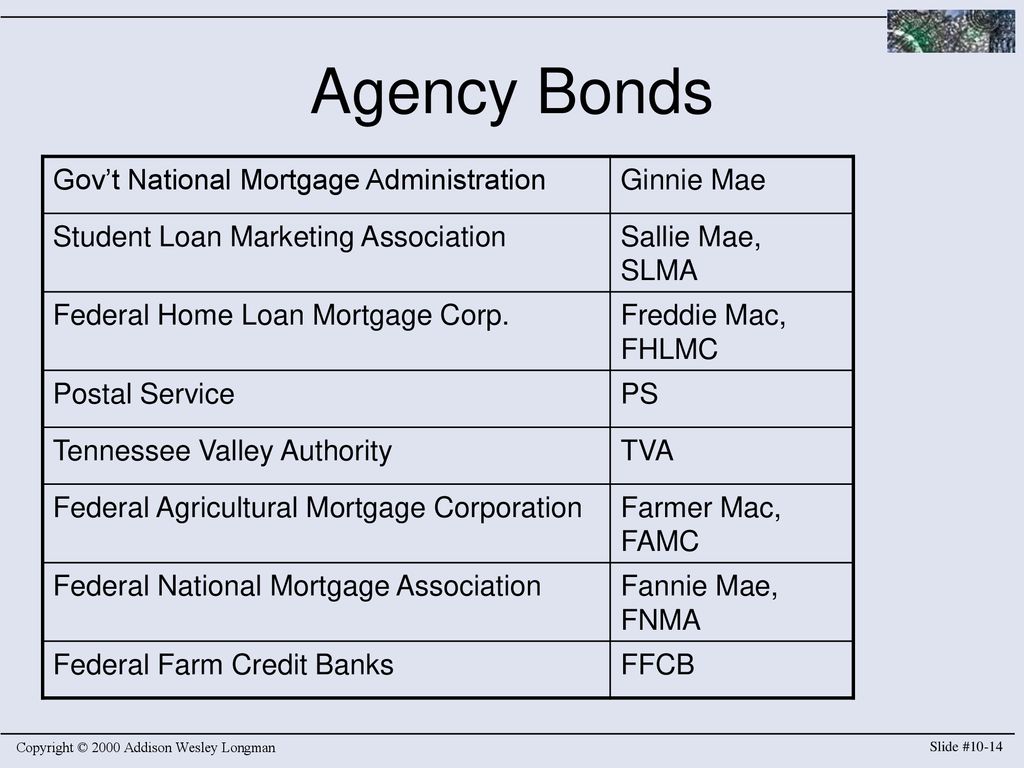

Chapter Ten The Capital Markets Ppt Download

c Radio 4 Loose Ends Miranda Sawyer Charley Pride Tracey Thorn Samantha Bond Clare Higgins The Staves 1 May 15 1 May 15

Bosagenda Countyofventura Org

Pearlandtx Gov

Investment Options For Advance Refunding Escrow Baker Tilly

Thenovaauthority Org

Solved I Need A Correction In This Exercise In The First Chegg Com

Frost Family Of Funds

Scioto County Deputies Say Body Of Missing Baby Found In Well Parents Arrested Wchs

2

Thenovaauthority Org

Agz Ishares Agency Bond Etf Portfolio Holdings 13f 13g

Ice Tmc What S New Previous Enhancements

Fs Omega Seamaster Bond Commander Watchuseek Watch Forums

Cross Body

2

Ice Tmc What S New Previous Enhancements

Ncsr Tit 0112 Htm Generated By Sec Publisher For Sec Filing

Econnectdirect Bond And Cd Market

Find A Loan Officer First Federal Community Bank

Thenovaauthority Org

Econnectdirect Fixed Income And Bonds

Countytreasurer Org

Heuer 1000 Bond Night Diver Lumi Dial St Steel Men S 41mm Watch 980 031n Watchcharts

The Debunker Is The Ideal Martini Shaken Not Stirred Woot

4 The Barrier To Rotation About The C C Bond In Chegg Com

Are Gnma Bonds Tax Exempt

Why Bond Is The Ultim8 In Haircare Treatments

Multi Bank Securities Inc Government Agencies Multi Bank Securities Inc

Bosagenda Countyofventura Org

Okaloosaclerk Com

Prospectus Bondtraderpro Com

Ecommons Cornell Edu

Cdiacdocs Sto Ca Gov

Cdiacdocs Sto Ca Gov

Grossmonthealthcare Org

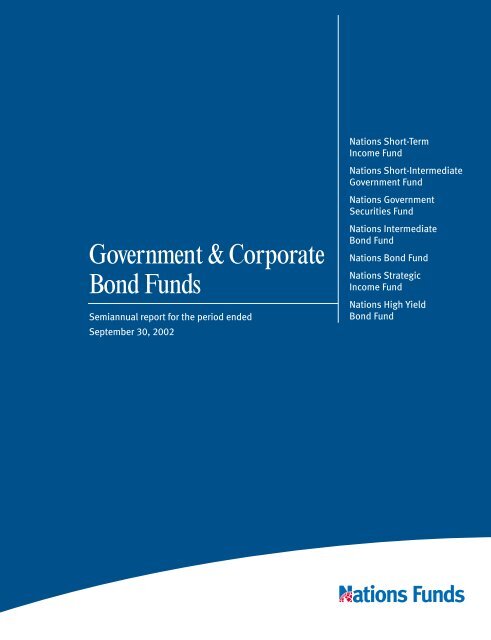

Solved 11 What Is The Strongest Intermolecular Force That Chegg Com

Mbssecurities Com

Federal Farm Credit Banks Funding Corporation

2

Simon Hurley Create Dye Ink Re Inker Breakup Blue

What Are Agency Bonds All About Dummies

Hungry Little Hare Literature Quiz Quizizz

How A Callable Bond Worked

Over Investing In New Issue Agency Callable Bonds Sin 1

Eq Advisors Trust Eq Intermediate Government Bond Portfolio Class Ia Portfolio Holdings 13f 13g

Mynevadacounty Com

The Commerce Funds

Huntsvilletx Gov

Unintended Consequences The Big Picture

Fn Capital Markets

Sarasotafl Gov

Hope That Remains Home Facebook

Government Amp Corporate Bond Funds

Countytreasurer Org

The Effects Of Government Sponsored Enterprise Gse Status On The Pricing Of Bonds Issued By The Federal Farm Credit Banks Funding Corporation Ffcb Emerald Insight

Grossmonthealthcare Org

Fildx Frost Low Duration Bond Fund Institutional Class Shares Portfolio Holdings 13f 13g

Ice Tmc What S New Previous Enhancements

Solved On December 31 18 When The Market Interest Rate Chegg Com

5 Years Ago Barton Industries Issued 25 Year Noncallable Semiannual Bonds With A 1 000 Face Value And A 6 Coupon Se Homeworklib

High Bond Set For Suspect In Fatal Charlestown Police Pursuit News Newsandtribune Com

Countytreasurer Org

Sbafla Com

Ffcb Federal Farm Credit Bank

Treasury Bonds

Ice Tmc What S New Previous Enhancements

Salt Lake City Based Simplus Acquired By India Based Infosys For 250m Kutv

Emerald Com

0 件のコメント:

コメントを投稿